Hourly Workers: Financial Security & Engagement

Well, to begin, you’d be in the majority. According to the U.S. Labor Department, more than 78 million Americans are paid on an hourly basis. That’s 59 percent of the workforce.

You’re also likely to be relatively young. Research from LinkedIn and Snagajob finds that 71% of hourly workers are under 30. And another 21% are in their 30s or 40s.

You might be surprised to learn that 45% of hourly workers over 30 have some post-secondary education. In fact, 15% have a Bachelor’s or Master’s Degree.

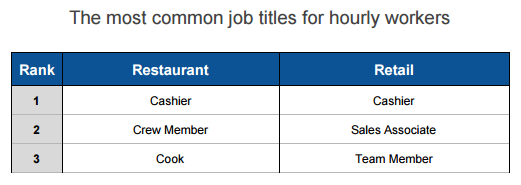

And then, there are the types of roles they may be taking. The most common roles are in retail and restaurants. And what are the most common job titles? Here are the top 3 in each sector:

So, what do hourly workers consider when applying for a job and comparing potential employers? One trend stands out: employee engagement. This is defined as the “extent to which employees care about their jobs, are committed to their employer, and put effort into their work.” Employee retention and tenure are highly correlated with highly engaged employees.

And employee loyalty, in this sense, can also create new career paths.

Whether the sector is retail, restaurant, healthcare or manufacturing, the LinkedIn/Snagajob study referenced above suggests there is a significant demand for people who develop certain key skills. Among the skills that unlock growth and financial opportunities for hourly workers:

“These skills are especially important if we consider how technological innovation impacts work,” according to the study. “While we can’t predict exactly how technology will redefine certain roles, we do know it’s easier to automate physical tasks like bagging groceries than it is to automate social and emotional ones like negotiating with a candidate.”

Financial Stress Leads to Disengagement at Work

But here’s the thing: Many hourly workers never get to seize these opportunities – or struggle unnecessarily to move up and make more. They experience difficult financial challenges along the way and these hurdles contribute to skill, learning, and employment gaps.

They may find themselves overwhelmed with financial crises and be less engaged at work.

The issues they face not only lead to distraction and disengagement but undermine career momentum. It could be an unexpected expense of any kind. A car breaks down. A medical procedure must be performed. A child needs extra care and attention. A creditor must be paid.

You never know. When you are living paycheck to paycheck, you are particularly vulnerable to events that can disrupt you financially and stop you from achieving financial goals in the long term.

And any financial blow that overwhelms you can undermine you at work leading to an actively disengaged workforce. And so goes the chain of events that make opportunity elusive to many hourly workers struggling to better themselves. These individual employees have a huge impact on creating an environment that nurtures and engaged workforce.

It’s bad for them – and it’s producing unnecessary costs that are bad for employers like you. After all, you’re now confronting an increasingly tight job market and are challenged to fill roles that demand experienced, skilled, and motivated workers.

Employers Have a Role to Play

What if you – as an employer – could offer a simple way for your employees to deal with unexpected financial stress? Might that help motivate your people to rise to new levels and grow with you?

These are the kinds of considerations that employers of choice are now taking very seriously. The best ones are methodically examining what needs to happen to deepen employee engagement and loyalty – and enable their people to take roles that require deeper skills and competencies. They know that such factors ultimately enhance the customer’s experience and produce measurable business results.

Employee engagement is inseparable from financial security and wellness. It’s about feeling safe – even when the unexpected occurs. And that’s why it makes sense to explore your options as an employer – and consider proven ways to support the financial wellness of your employees.

Get Payactiv for your business

Related Articles

For decades, many hourly workers drew the short straw in regard to employee...

For many people, their first big purchase is their first car You need a vehicle...

Over half of North American employees are more stressed about their finances...

© 2025 Payactiv, Inc. All Rights Reserved

24 hour support: 1 (877) 937-6966 | [email protected]

* The Payactiv Visa Prepaid Card and the Payactiv Visa Payroll Card are issued by Central Bank of Kansas City, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. You should consult your Cardholder Agreement and the Fee Schedule at payactiv.com/card411. If you have questions regarding the Card or such fees, terms, and conditions, you can contact us toll-free at 1-877-747-5862, 24 hours a day, 7 days a week.

** Central Bank of Kansas City does not administer, nor is liable for earned wage access.

Payactiv holds earned wage access services (EWA) license number 2591928EWA with the Wisconsin Department of Financial Institutions.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Google Play and the Google Play logo are trademarks of Google LLC.

Galaxy Store and the Galaxy Store logo are registered trademarks of Samsung Electronics Co., Ltd.