Are Your Employees Struggling to Pay Utility Bills?

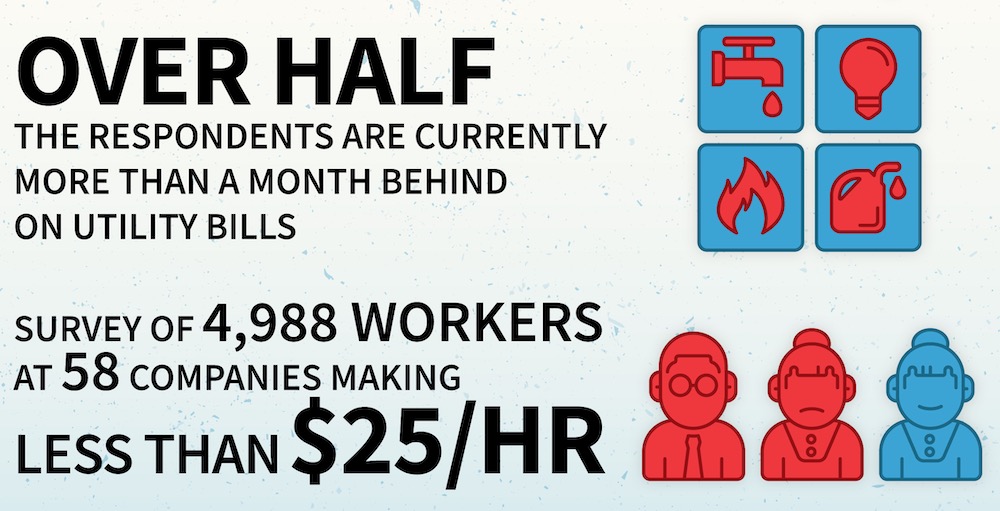

PayActiv surveyed 5,000 workers making less than $25 per hour across 58 companies in retail, manufacturing, healthcare, senior care, and hospitality jobs. Over half the participants were more than a month behind on utility bills.

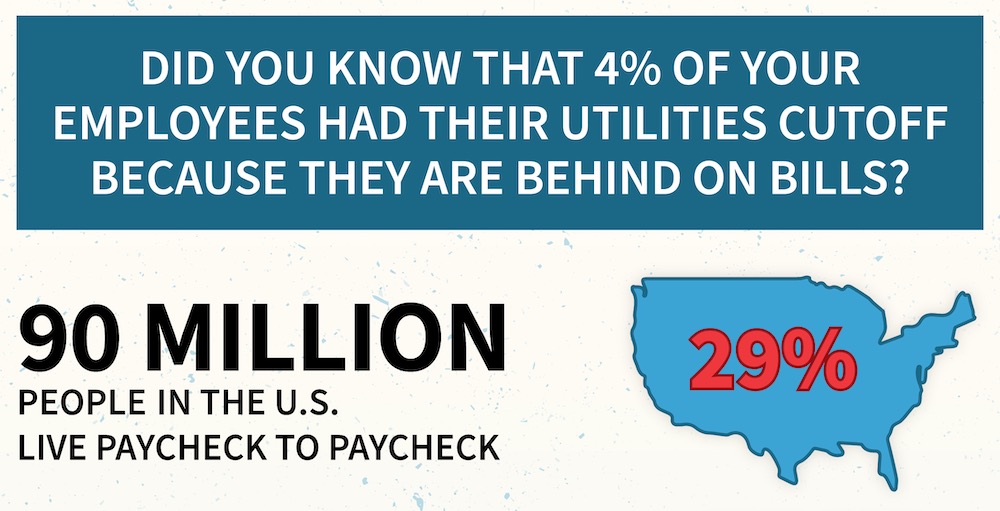

When you are worried about having the power, water, or gas shut off, it is difficult, if not impossible, for workers to concentrate on the task at hand. Many hourly workers who struggle with paycheck-to-paycheck living suffer from acute financial stress that affects cognitive processes, damages health, and compromises the capacity to cope emotionally much as PTSD does. According to the survey, 4% of workers have had their utilities shut off for lack of payment. However, when deciding between paying the rent, buying groceries, or paying the utility company, it’s no surprise to see which bills go by the wayside.

Are there solutions that can help?

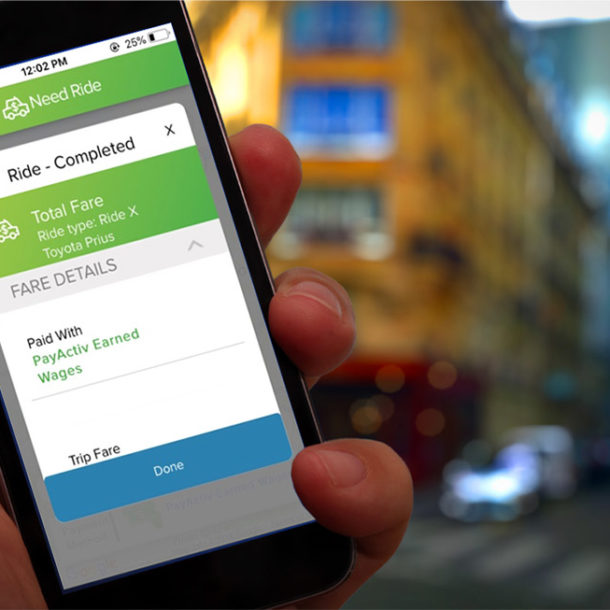

In desperation, people turn to predatory payday loans and other high-interest traps, but the costs of such products put workers even farther behind. With interest rates in the hundreds of percentage points in APR, this type of lending just digs a deeper financial hole. That’s where PayActiv comes in. At no cost to employers and just $5 per pay period for employees, they can get access to earned wages and avoid predatory debt and fee traps. PayActiv also includes tools to help budget and automate savings at no extra cost. When your employees have access to the PayActiv benefit, they can tap into earned wages to pay their bills on time every month and keep the lights on, something every working individual deserves.

Services that help regain control

Among the many free features and benefits of PayActiv is a bill pay service. When workers set up their PayActiv account, they can start using the free online bill pay service. Even if they don’t have a regular checking account, using PayActiv they can pay bills just like if they had one. With a holistic set of financial tools, workers can improve their financial knowledge and turn around a challenging financial situation. When employers can help their workers succeed with their money, it is a big win-win for everyone involved.

Get Payactiv for your business

Related Articles

April is Financial Literacy Month, a great time for employers to focus on the...

As inflation and the cost of living continue to rise, employees feel the...

If there’s anything the events of the last two years and the ongoing impact...

© 2024 Payactiv, Inc. All Rights Reserved

24 hour support: 1 (877) 937-6966 | [email protected]

* The Payactiv Visa Prepaid Card is issued by Central Bank of Kansas City, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. You should consult your Cardholder Agreement and the Fee Schedule at payactiv.com/card411. If you have questions regarding the Card or such fees, terms, and conditions, you can contact us toll-free at 1-877-747-5862, 24 hours a day, 7 days a week.

** Central Bank of Kansas City is the issuer of the Payactiv Visa Prepaid Card only and does not administer, endorse, nor is liable for the Payactiv App.

1 Standard rates for data and messaging may apply from your wireless provider.

Google Play and the Google Play logo are trademarks of Google LLC.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.